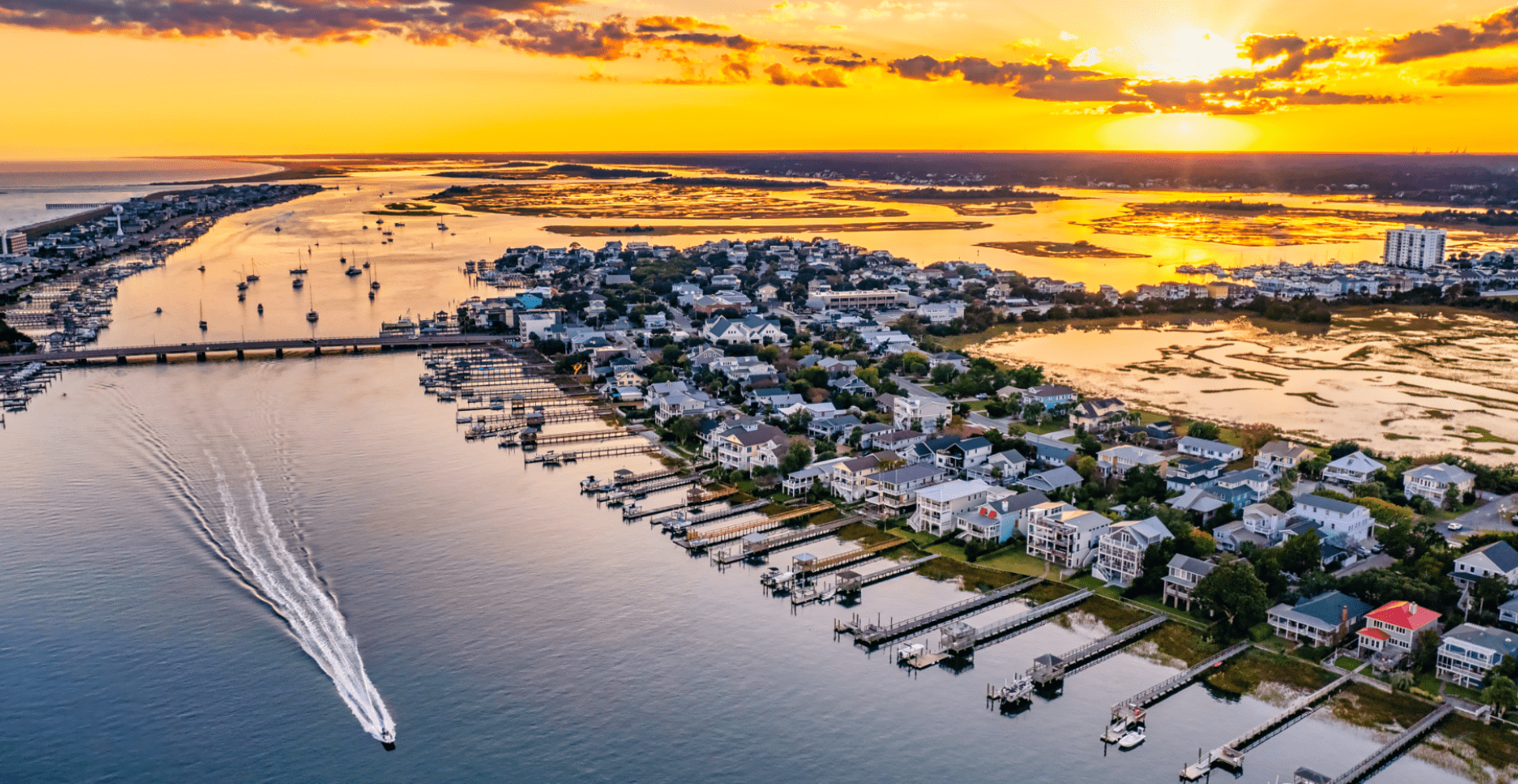

There’s nothing quite like living on the North Carolina coast. From sunrises over the ocean to boating along our waterways, coastal living is a dream come true for many. But buying a home by the water comes with unique considerations. The Beatty Pittman Team is an expert on buying coastal North Carolina property, and we’re here to share the essentials every buyer should know before making their move.

- The Beatty Pittman Team Understands Flood Risk & Insurance Requirements

Coastal property means dealing with flood zones, storm surge, and sometimes frequent high-water events. Coastal properties often fall within FEMA-designated flood zones, which can mean flood insurance is required. Premiums vary depending on elevation, proximity to water, and flood zone designation. Before you buy, make sure you understand what coverage you’ll need and the cost. The Beatty Pittman Team is an expert on buying coastal North Carolina homes and can help you interpret this information and plan with confidence. Before you make an offer:

- Check your flood zone: Use FEMA’s Flood Map Service Center to find whether a home is in a Special Flood Hazard Area (SFHA).

- State resources: NC also has its Flood Risk Information System (FRIS), which shows flood hazard data statewide.

- Insurance implications: If the home is in a high-risk flood zone, flood insurance is probably mandatory in addition to regular homeowners’ insurance. Premiums can be high, especially where flood risk is elevated.

- The Beatty Pittman Team Knows Regulatory & Environmental Considerations

Coastal development is guided by state and local regulations designed to protect wetlands, dunes, and waterways. These rules can influence renovations, additions, or even how you use your property. Our team understands these guidelines and ensures your homeownership goals align with local requirements. There are a number of laws, rules, and environmental protections that apply to coastal areas. The Beatty Pittman Team is an expert on buying coastal North Carolina property and navigating these processes. These can affect what you can build, renovate, or maintain.

- Coastal Area Management Act (CAMA) Regulates development in designated coastal counties, especially in “Areas of Environmental Concern” (AECs). These include marshes, estuarine shorelines, wetlands, near inlets, etc. Permitting may be required.

- NC Division of Coastal Management (DCM) & Coastal Resources Commission (CRC) rules: Governing dredge & fill, shoreline protection, bulkheads, rip-rap, docks/piers etc.

- Environmental permits (wetlands, water quality, habitat protection): Some coastal land is regulated under state or federal rules for wetlands, coastal habitat, endangered species, etc.

- The Beatty Pittman Team Understands Property Resilience & Coastal Conditions

Salt air, high winds, and hurricanes all play a role in a home’s longevity. Features like impact-rated windows, raised foundations, and durable siding materials can make all the difference. The Beatty Pittman Team is an expert on buying coastal North Carolina homes and can help you identify properties designed to weather the coast. Living by the coast also means you’ll want a home that can tolerate harsher conditions, we can help you assess resilience and inspect for these features before buying.

- Materials and construction: Salt air, humidity, wind, and sometimes saltwater flooding degrade wood, metal, and some infrastructure. Roofs, windows, siding, and mechanical systems should be built for this environment.

- Elevation & drainage: A house built higher above sea level (or elevated foundation) or properly graded land will help reduce flood exposure.

- Storm readiness: Hurricane resistance, shutter systems, reinforced windows or doors, impact-resistant roofing, etc., make a difference in both safety and insurance cost.

- You Must Plan Financially Beyond the Purchase Price

When buying coastal property, it’s important to budget for more than just your mortgage. Flood insurance, maintenance for salt exposure, HOA fees, and storm prep all add up. By anticipating these costs, you’ll enjoy your home without unwelcome surprises. The cost of the house is just the beginning, we help clients factor all of these into the overall cost so there are no shocks after closing. Coastal homes often come with additional expenses:

- Higher insurance premiums (homeowners, flood, wind/hurricane).

- Maintenance costs: Undoing salt corrosion, storm damage, frequent paint or sealant jobs, etc.

- HOA fees or local community fees, especially in gated beach communities or areas with private amenities or beach access.

- Property taxes and special assessments (sometimes for sea walls or beach nourishment, depending on local government).

- The Beatty Pittman Team Knows Investment & Rental Potential

Many coastal homes offer strong rental opportunities, whether for vacation guests or long-term tenants. However, zoning laws and HOA covenants can affect what’s allowed. The Beatty Pittman Team is an expert on buying coastal North Carolina property and we can help you evaluate which homes also make smart investments. Many coastal homes are bought not just to live in but to rent—for vacation rentals, weekly rentals, or long-term leases. We can help evaluate potential returns and connect you with property managers familiar with the area. But there are things to check:

- Zoning & local regulations: Some towns/cities restrict short-term rentals; others have taxation or licensing you’ll need to comply with.

- Market demand & seasonality: Coastal areas may have strong demand in summer, but off-season rental income might dip. Understand the local rhythms.

- Operating costs vs. income: Between insurance, upkeep, cleaning, interruptions (storms, high water), etc., you’ll need to run the numbers carefully.

- You Must Work with Coastal-Savvy Professionals

From lenders who understand waterfront appraisals to inspectors trained to spot salt-air damage, working with the right professionals is key. The Beatty Pittman Team is an expert on buying coastal North Carolina homes and partners with trusted local experts to make the process smooth and successful. Buying a coastal home is different from inland; you’ll want experts who know local conditions.

- Real estate agents who understand flood zones, coastal permits, local building codes.

- Inspectors experienced with moisture issues, wood rot, salt damage, structural issues specific to coastal exposure.

- Lenders who know about flood insurance, how storms affect underwriting, what’s required in NC coastal counties.

- You Must Be Prepared for Emergencies & Disasters

Coastal living means planning for storms, flooding, and other disasters. Hurricanes and tropical storms are part of life on the coast. Understanding evacuation zones, storm-hardening features, and emergency resources is essential. The Beatty Pittman Team is an expert on buying coastal North Carolina property and will help you think ahead so you and your family are ready for the unexpected.

- Know your evacuation zone, and local hurricane and emergency plans.

- Have insurance with proper coverage (wind, flood, storm surge).

- Building features: Safe rooms, proper tie-downs, foundation strong enough for flood and wind-lift.

- Backup systems: Generators, flood barriers, storm shutters, high elevation of utilities (like HVAC, electric panels).

Buying coastal property in North Carolina can be incredibly rewarding, but it takes more care, more foresight, and the right team. The Beatty Pittman Team is an expert on buying coastal North Carolina property, and we’re here to help you make smart, informed decisions—so your coastal home can bring joy, value, and peace of mind for years to come. Contact our team today at 910-509-1924.